JKH posts strong Q3 EBITDA growth of 68% to Rs.23.76 billion driven by momentum across the portfolio

Summarised below are the key operational and financial highlights of our performance during the quarter under review:

- The Group continued to deliver a strong performance, with all businesses reporting improved profitability.

- The operationalisation of two of the Group’s largest projects, the City of Dreams Sri Lanka integrated resort and the West Container Terminal (WCT-1) at the Port of Colombo, continued to progress well. The encouraging quarter-on-quarter momentum demonstrates the strong ramp up potential of both projects.

- The country faced an unexpected challenge in November with Cyclone Ditwah, which impacted parts of Southeast and South Asia. The cyclone caused loss of lives, affected a significant portion of the population, and resulted in considerable infrastructure damage in certain areas of Sri Lanka. While the operations of the Group were disrupted during the few days of the cyclone, there were no significant operational or financial impact as a direct result of the cyclone and related flooding.

- The Group and its staff supported relief efforts through various initiatives, including a substantial contribution of Rs.500 million from John Keells Holdings PLC and its affiliate companies towards the Government’s ‘Rebuilding Sri Lanka’ initiative.

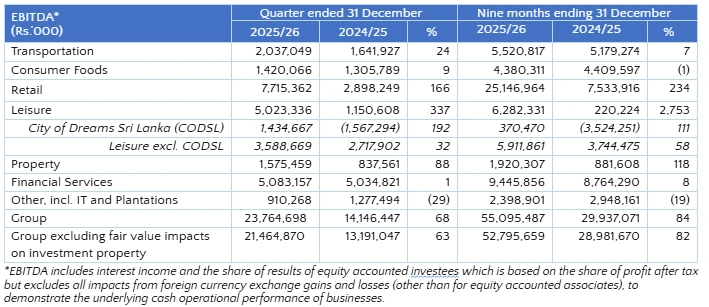

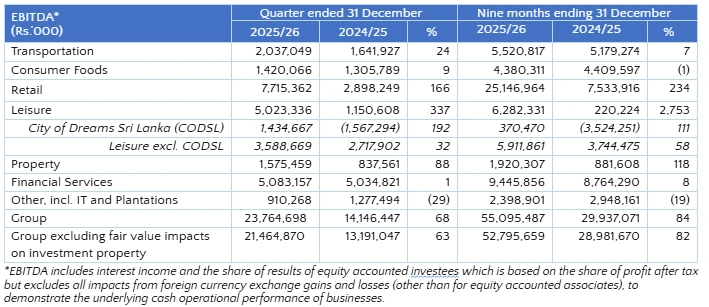

- Group earnings before interest, tax, depreciation and amortisation (EBITDA) at Rs.23.76 billion in the third quarter of the financial year 2025/26 is an increase of 68% against Group EBITDA of Rs.14.15 billion recorded in the third quarter of the previous financial year.

- Cumulative Group EBITDA for the first nine months of the financial year 2025/26 at Rs.55.10 billion is an increase of 84% against the EBITDA of Rs.29.94 billion recorded in the same period of the financial year 2024/25.

- During the quarter under review, the Group recorded fair value gains on investment property amounting to Rs.2.30 billion [2024/25 Q3: Rs.955 million], and net exchange losses of Rs.759 million [2024/25 Q3: gain of Rs.782 million], mainly due to the impact of the deprecation of the Rupee on the foreign currency denominated loan at City of Dreams Sri Lanka.

- Profit attributable to equity holders of the parent is Rs.6.48 billion in the quarter under review, which includes fair value gains on investment property and net exchange losses amounting to Rs.1.45 billion. Profit attributable to equity holders of the parent for the corresponding period of the previous financial year was Rs.2.85 billion, which included fair value gains on investment property and net exchange gains amounting to Rs.1.70 billion.

- The second interim dividend for FY2026 of Rs. 0.10 per share is aligned with the first interim dividend paid in November 2025. This reflects the expectation that the current momentum of performance will sustain or further improve going forward. The outlay for the second interim dividend is Rs.1.77 billion, which is an increase compared to Rs.881 million in the previous year.

- City of Dreams Sri Lanka recorded a positive EBITDA for the first time since commencing operations, with an EBITDA of Rs.1.43 billion, which includes fair value gains on investment property amounting to Rs.606 million. EBITDA for the corresponding period of the previous financial year was negative Rs.1.57 billion, and did not include fair value gains on investment property. The Cinnamon Life and Nuwa hotels continue to be positively received by the market, both locally and internationally, while performance of the casino has seen a steady improvement.

- The Sri Lankan Leisure businesses recorded a strong performance driven by an improvement in occupancy on the back of increased arrivals.

- Colombo West International Terminal, the project company of the West Container Terminal (WCT-1), continued to record steady month-on-month growth in throughput, supported by an improved volume mix that contributed positively to profitability. The business recorded a positive profit-after-tax (PAT), ahead of expectations, despite recognising depreciation and a portion of finance expenses relating to phase 1, with the quantum relevant to phase 2 being capitalised, following the commencement of operations.

- Despite the ongoing Sri Lanka Customs dispute and the normalisation of pent-up demand, JKCG recorded a strong performance during the quarter. JKCG has a very healthy order pipeline with over 3,900 vehicles to be delivered in the ensuing months.

- All the other businesses showed growth during the quarter under review with expectations of witnessing growth in the ensuing quarter.

JKH posts strong Q3 EBITDA growth of 68% to Rs.23.76 billion driven by momentum across the portfolio

Summarised below are the key operational and financial highlights of our performance during the quarter under review:

- The Group continued to deliver a strong performance, with all businesses reporting improved profitability.

- The operationalisation of two of the Group’s largest projects, the City of Dreams Sri Lanka integrated resort and the West Container Terminal (WCT-1) at the Port of Colombo, continued to progress well. The encouraging quarter-on-quarter momentum demonstrates the strong ramp up potential of both projects.

- The country faced an unexpected challenge in November with Cyclone Ditwah, which impacted parts of Southeast and South Asia. The cyclone caused loss of lives, affected a significant portion of the population, and resulted in considerable infrastructure damage in certain areas of Sri Lanka. While the operations of the Group were disrupted during the few days of the cyclone, there were no significant operational or financial impact as a direct result of the cyclone and related flooding.

- The Group and its staff supported relief efforts through various initiatives, including a substantial contribution of Rs.500 million from John Keells Holdings PLC and its affiliate companies towards the Government’s ‘Rebuilding Sri Lanka’ initiative.

- Group earnings before interest, tax, depreciation and amortisation (EBITDA) at Rs.23.76 billion in the third quarter of the financial year 2025/26 is an increase of 68% against Group EBITDA of Rs.14.15 billion recorded in the third quarter of the previous financial year.

- Cumulative Group EBITDA for the first nine months of the financial year 2025/26 at Rs.55.10 billion is an increase of 84% against the EBITDA of Rs.29.94 billion recorded in the same period of the financial year 2024/25.

- During the quarter under review, the Group recorded fair value gains on investment property amounting to Rs.2.30 billion [2024/25 Q3: Rs.955 million], and net exchange losses of Rs.759 million [2024/25 Q3: gain of Rs.782 million], mainly due to the impact of the deprecation of the Rupee on the foreign currency denominated loan at City of Dreams Sri Lanka.

- Profit attributable to equity holders of the parent is Rs.6.48 billion in the quarter under review, which includes fair value gains on investment property and net exchange losses amounting to Rs.1.45 billion. Profit attributable to equity holders of the parent for the corresponding period of the previous financial year was Rs.2.85 billion, which included fair value gains on investment property and net exchange gains amounting to Rs.1.70 billion.

- The second interim dividend for FY2026 of Rs. 0.10 per share is aligned with the first interim dividend paid in November 2025. This reflects the expectation that the current momentum of performance will sustain or further improve going forward. The outlay for the second interim dividend is Rs.1.77 billion, which is an increase compared to Rs.881 million in the previous year.

- City of Dreams Sri Lanka recorded a positive EBITDA for the first time since commencing operations, with an EBITDA of Rs.1.43 billion, which includes fair value gains on investment property amounting to Rs.606 million. EBITDA for the corresponding period of the previous financial year was negative Rs.1.57 billion, and did not include fair value gains on investment property. The Cinnamon Life and Nuwa hotels continue to be positively received by the market, both locally and internationally, while performance of the casino has seen a steady improvement.

- The Sri Lankan Leisure businesses recorded a strong performance driven by an improvement in occupancy on the back of increased arrivals.

- Colombo West International Terminal, the project company of the West Container Terminal (WCT-1), continued to record steady month-on-month growth in throughput, supported by an improved volume mix that contributed positively to profitability. The business recorded a positive profit-after-tax (PAT), ahead of expectations, despite recognising depreciation and a portion of finance expenses relating to phase 1, with the quantum relevant to phase 2 being capitalised, following the commencement of operations.

- Despite the ongoing Sri Lanka Customs dispute and the normalisation of pent-up demand, JKCG recorded a strong performance during the quarter. JKCG has a very healthy order pipeline with over 3,900 vehicles to be delivered in the ensuing months.

- All the other businesses showed growth during the quarter under review with expectations of witnessing growth in the ensuing quarter.

Latest News

JKH posts strong Q3 EBITDA growth of 68% to Rs.23.76 billion driven by momentum across the portfolio

28 January, 2026

John Keells Holdings PLC Doubles EBITDA to Rs.18.3Bn, Signals Even Stronger Second-Half

04 November, 2025