JKH records strong performance in Q1 2025/26; EBITDA of Rs.12.97 billion

Summarised below are the key operational and financial highlights of our performance during the quarter under review:

• Group revenue at Rs.114.15 billion for the period under review is an increase of 64% over the Rs.69.66 billion recorded in the first quarter of the previous financial year.

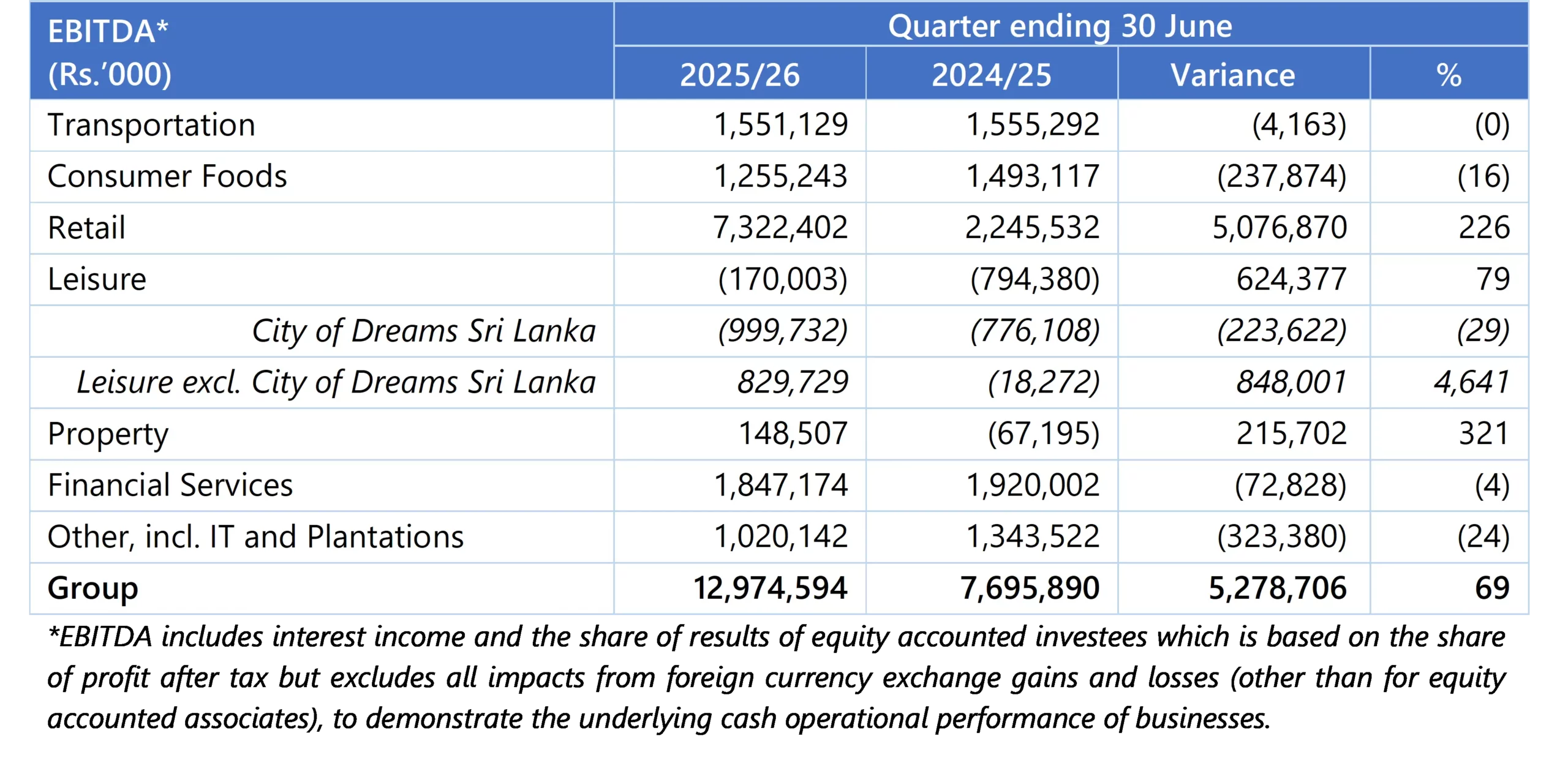

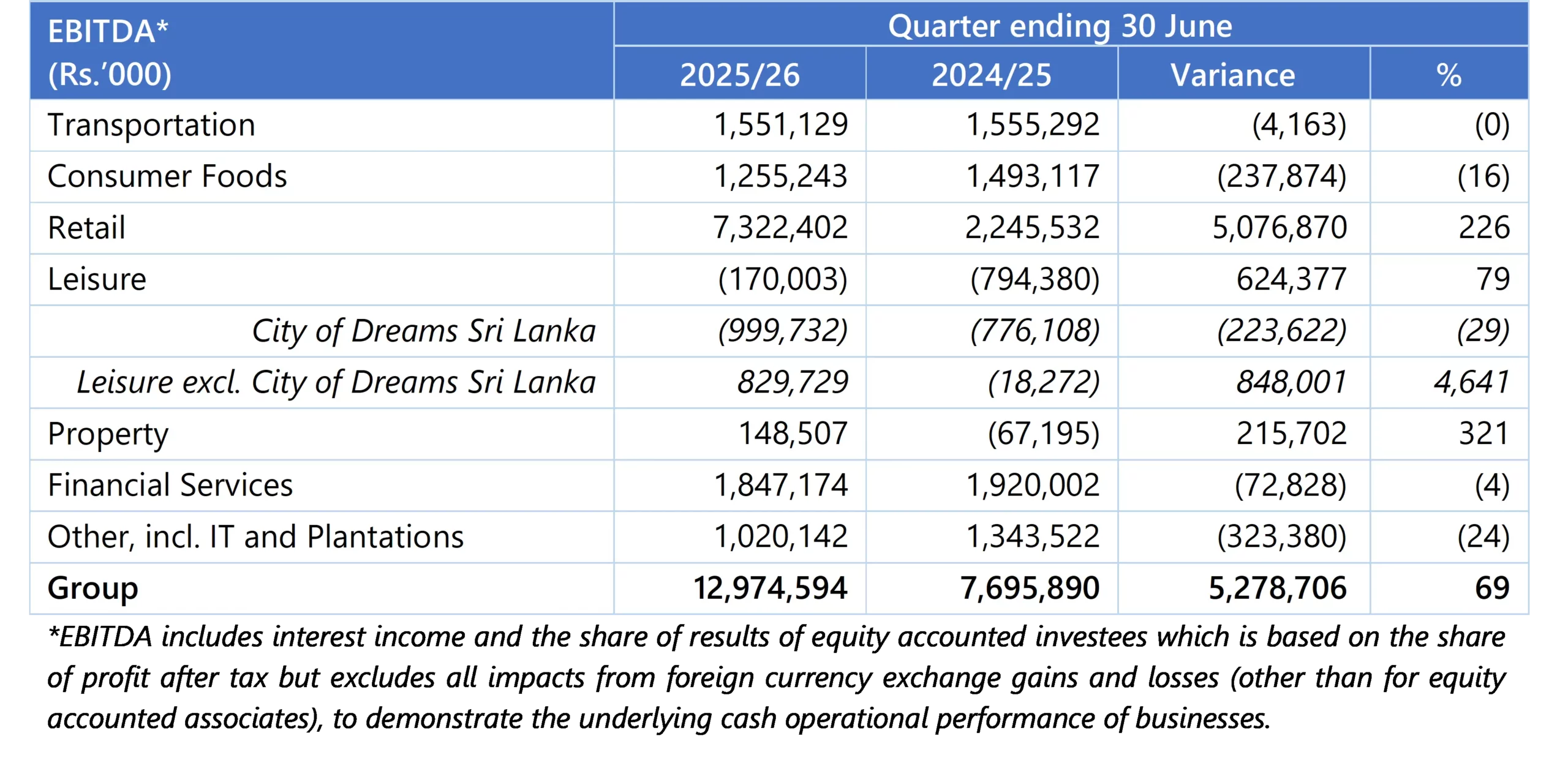

• Group EBITDA at Rs.12.97 billion in the first quarter of the financial year 2025/26 is an increase of 69% over the EBITDA of Rs.7.70 billion recorded in the corresponding period of the previous financial year.

• The Group recorded a significant growth in revenue and EBITDA primarily on account of the Retail industry group, aided by the performance of the Supermarket and New Energy Vehicle (NEV) businesses.

• The Group marked the first full quarter of commercial operations at the West Container Terminal (WCT-1) at the Port of Colombo. The trajectory of volume ramp-up over the quarter at WCT-1 has exceeded expectations and operational productivity has scaled up significantly over the last few months. At this initial stage of operations, there will be a negative impact on EBITDA since the Group recognises the share of profit after tax as the business is treated as an equity accounted investee.

• The remaining components of the Group’s flagship integrated resort, City of Dreams Sri Lanka, are scheduled to launch on August 2, 2025, with the operationalisation of all elements including a top-tier international standard casino, the ultra-luxury Nuwa hotel, and the premium lifestyle focussed shopping mall.

• Excluding WCT-1, the Transportation industry group EBITDA increased by 11%, mainly driven by the Group’s Bunkering business, Lanka Marine Services (LMS).

• The Beverages business recorded a volume decline of 10%, in line with that witnessed in the market, due to unseasonal adverse weather conditions which prevailed across the country while the Confectionery business recorded a volume growth of 3%, driven by both the impulse and bulk segments.

• The Supermarket business recorded a strong performance during the quarter, with same store sales recording an encouraging growth of 13% driven by customer footfall growth of 17%. Growth was further aided by the contribution from new stores.

• John Keells CG Auto, the Group’s NEV business, recorded an encouraging order book. Total orders received to date have exceeded expectations. During the quarter under review, a material number of vehicles were handed over to customers.

• The Leisure businesses recorded an improvement in profitability and margins driven by higher occupancies on the back of improved arrivals.

• The Property industry group recorded an increase in profitability driven by sales at the Cinnamon Life, TRI-ZEN and VIMAN residential development projects and from real estate sales in Digana, through Rajawella Holdings (Private) Limited.

• Nations Trust Bank recorded a strong growth in profitability aided by loan growth and lower impairments.

• Excluding the Cinnamon Life hotel, the carbon footprint and water withdrawal per million rupees of revenue decreased by 8.3% and 9.5% respectively.

Summarised below are the key operational and financial highlights of our performance during the quarter under review:

• Group revenue at Rs.114.15 billion for the period under review is an increase of 64% over the Rs.69.66 billion recorded in the first quarter of the previous financial year.

• Group EBITDA at Rs.12.97 billion in the first quarter of the financial year 2025/26 is an increase of 69% over the EBITDA of Rs.7.70 billion recorded in the corresponding period of the previous financial year.

• The Group recorded a significant growth in revenue and EBITDA primarily on account of the Retail industry group, aided by the performance of the Supermarket and New Energy Vehicle (NEV) businesses.

• The Group marked the first full quarter of commercial operations at the West Container Terminal (WCT-1) at the Port of Colombo. The trajectory of volume ramp-up over the quarter at WCT-1 has exceeded expectations and operational productivity has scaled up significantly over the last few months. At this initial stage of operations, there will be a negative impact on EBITDA since the Group recognises the share of profit after tax as the business is treated as an equity accounted investee.

• The remaining components of the Group’s flagship integrated resort, City of Dreams Sri Lanka, are scheduled to launch on August 2, 2025, with the operationalisation of all elements including a top-tier international standard casino, the ultra-luxury Nuwa hotel, and the premium lifestyle focussed shopping mall.

• Excluding WCT-1, the Transportation industry group EBITDA increased by 11%, mainly driven by the Group’s Bunkering business, Lanka Marine Services (LMS).

• The Beverages business recorded a volume decline of 10%, in line with that witnessed in the market, due to unseasonal adverse weather conditions which prevailed across the country while the Confectionery business recorded a volume growth of 3%, driven by both the impulse and bulk segments.

• The Supermarket business recorded a strong performance during the quarter, with same store sales recording an encouraging growth of 13% driven by customer footfall growth of 17%. Growth was further aided by the contribution from new stores.

• John Keells CG Auto, the Group’s NEV business, recorded an encouraging order book. Total orders received to date have exceeded expectations. During the quarter under review, a material number of vehicles were handed over to customers.

• The Leisure businesses recorded an improvement in profitability and margins driven by higher occupancies on the back of improved arrivals.

• The Property industry group recorded an increase in profitability driven by sales at the Cinnamon Life, TRI-ZEN and VIMAN residential development projects and from real estate sales in Digana, through Rajawella Holdings (Private) Limited.

• Nations Trust Bank recorded a strong growth in profitability aided by loan growth and lower impairments.

• Excluding the Cinnamon Life hotel, the carbon footprint and water withdrawal per million rupees of revenue decreased by 8.3% and 9.5% respectively.

Latest News

JKH posts strong Q3 EBITDA growth of 68% to Rs.23.76 billion driven by momentum across the portfolio

28 January, 2026

John Keells Holdings PLC Doubles EBITDA to Rs.18.3Bn, Signals Even Stronger Second-Half

04 November, 2025